I occasionally transfer money from the U.S. to Thailand via an online digital payments service. It is easy to do, doesn’t require leaving home and, with bank rates to wire money still so expensive, using a digital payments service usually saves me money.

The last few times I transferred money from my U.S. bank account to my Thai account, I used World Remit.

The last time I attempted to use the service, however, no matter what I tried it would not accept a transfer via my debit card, nor directly from my bank account. Even though I had used both methods with the company at least 10 times before.

In frustration, I opened an account with Transferwise — which, due to a bad branding decision, is now just known as Wise.

Imagine my surprise to quickly learn, not only is sending money from the U.S. to Thailand via Transferwise (Wise) one of the easiest things I have ever done, the exchange rate and Wise’s low fee means I saved over $14 on a $1,000 transfer compared to the exchange rate and fees World Remit would have charged me.

Will I be using Transferwise (Wise) to send money from the U.S. to Thailand from now on? Definitely.

Transferwise (Wise) is easy to use

Setting up an account with Transferwise (Wise) is easy.

All I needed was my U.S. bank information and the details for my bank account in Thailand. All in all, opening a Transferwise (Wise) account to send money to Thailand took less than 10 minutes.

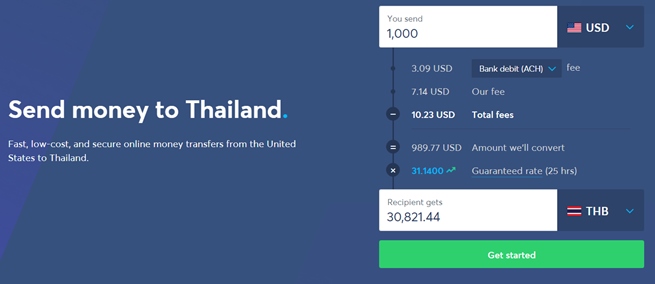

Once the account was confirmed, I chose myself as the recipient of the money I wanted to send, keyed in the number of dollars I wished to send, checked the amount of the fee and the exchange rate, along with the amount in Thai baht I was guaranteed to receive.

What I quickly noticed was, while the fee Transferwise charges is higher than the one charged by World Remit, the total cost of the actual transfer is cheaper than World Remit simply because the exchange rate Transferwise offers between the U.S. dollar and the Thai baht is higher.

The speed of a Transferwise (Wise) transfer from the U.S. to Thailand is very fast

Every time I have sent money to Thailand via World Remit, it has taken at least 3 days for it to show up in my Thai bank account. During those three days, I hear nothing from World Remit except an initial email saying the money has been sent.

With a Transferwise (Wise) transfer from the U.S. to Thailand, however, the money I had sent to my Thai bank account appeared in my online account in under two minutes. Next to it was notification that it would be available for withdrawal two days later.

Sure, I could not withdraw the money for two more days, which is actually due to my Thai bank’s policies and not to Transferwise, but I knew just a couple of minutes after I had sent the money that my Thai bank had already received it.

That gave me an added level of confidence my money would be available when I wanted it.

With World Remit, however, notification of the transfer never appeared in my Thai bank account until the money was available to withdraw.

The benefits of using Transferwise (Wise) to send money to Thailand

For me, the benefits of using Transferwise (Wise) to send money from the U.S. to Thailand were three-fold.

- An easier service to use, and none of the problems using a debit card or my bank account like I recently experienced with World Remit.

- The ability to send money from the U.S. to Thailand quickly, and to know it has been received by my Thai bank only minutes after sending it.

- Wise offers a higher exchange rate than any other online digital payments service I have used, meaning I receive more baht in my bank account in Thailand with Wise than with any other service.

All in all, I am extremely happy I made a quick decision to open a Transferwise (Wise) account, and now plan on using the company to send money from the U.S. to Thailand often.

And, of course, if I send money to anyone else in Thailand other than myself, I will also use Wise. Especially as the person receiving the money does not need to have a Wise account to get it.